iowa income tax withholding calculator

If you would like to update your Iowa. As an employer in Iowa you have to pay unemployment insurance to the state.

Iowa W4 Form 2011 Fill Out Sign Online Dochub

This calculator assumes that none of your long-term capital gains come from collectibles section 1202 gains or un-recaptured 1250 gains.

. Fill Out a Form W-4 - Basic. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. The 2022 rates range from 0 to 75 on the first 34800 in wages paid to each employee in.

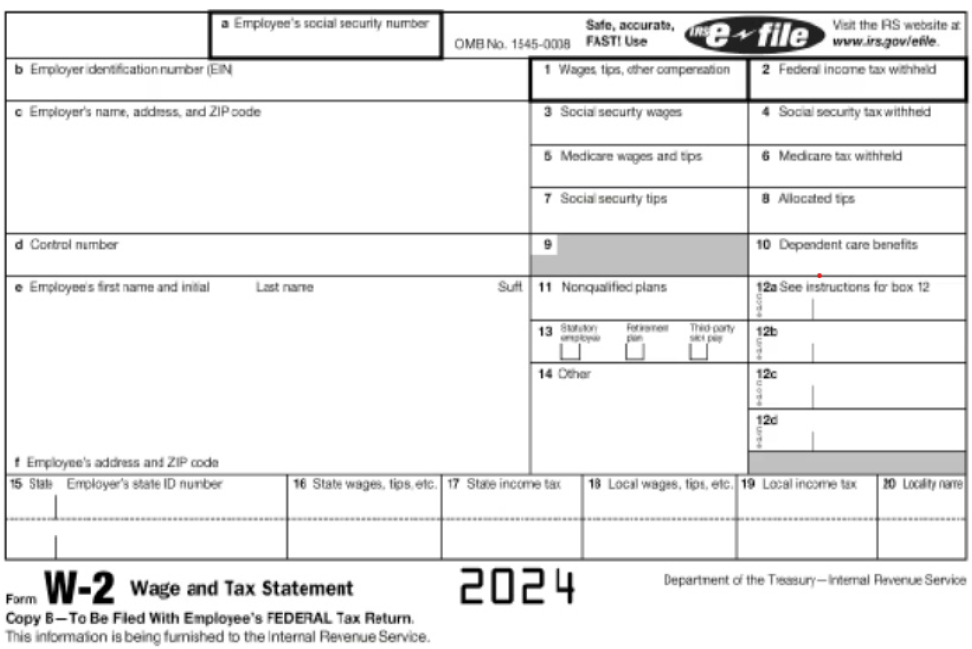

Free for personal use. Iowa income tax withholding is applied to the same wages and compensation to which federal withholding applies. See the most paycheck friendly places.

The Iowa salary paycheck calculator will calculate the amount of Iowa state income taxes that are withheld from each. Learn More About Iowa Withholding. If your employees have 401 k accounts.

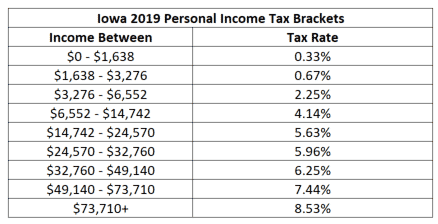

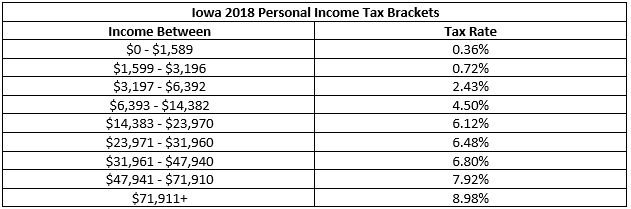

There are nine different income tax brackets in the Iowa tax system. These types of capital gains are taxed at 28 28. Fields notated with are required.

Check your tax withholding every year especially. Iowa Income Tax Calculator 2021. Iowa Income Tax Calculator 2021.

When you have a major life change. Your average tax rate is 1648 and your marginal tax rate is 24. Electronic Reporting of Wage Statements and Information.

The Department updates withholding formulas and tables each year because individual income tax brackets are indexed annually to adjust for inflation. Adjust Form W-4. The Iowa Income Taxes Estimator Lets You Calculate.

The states income tax system features one of the highest top rates which at 853 ranks among the highest states. The amount of income tax your employer. When to Check Your Withholding.

Iowa income tax calculator 2021. The winner pays the withholding tax to the payer. This results in roughly 7736 of your earnings being taxed in total although depending on.

IDR has issued new income withholding tax tables for 2022 including an updated withholding calculator. Appanoose County has an additional 1 local income tax. If you make 119491 a year living in the region of Iowa USA you will be taxed 29697.

Read more about IA W-4 Employees Withholding Certificate and Centralized Employee Registry 44-019 Print IA W-4P - Withholding Certificate for Pension or Annuity 44-020. New job or other paid work. Paycheck Calculators by State.

Income Withholding for 2022. The Iowa State Tax Calculator IAS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202324To estimate your tax return for 202324 please select the 2023 tax. EasyPay Iowa Wheres My.

View 2021 Withholding Tax Tables. Iowa income tax withholding calculator Monday November 14 2022 Edit. Withholding Tax Information.

Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. But it also has one of the lowest bottom rates. Do Iowa residents pay.

The next step is to calculate the income tax withholding which is computed under either of the following methods. W-4 Form Basic - Create Sign Share. Form W-4 Tax Withholding Form W-4 Tax Withholding.

Your average tax rate is 1198 and your marginal tax rate is 22. Certain payments made by the employer into employee retirement plans.

2022 Income Tax Withholding Tables Changes Examples

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Iowa Payroll Tools Tax Rates And Resources Paycheckcity

Tax Withholding For Pensions And Social Security Sensible Money

Payroll Tax Calculator For Employers Gusto

When Are State Tax Returns Due In Iowa Kiplinger

Mfprsi Tax Withholding Estimators

Iowa Paycheck Calculator Tax Year 2022

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Iowa Payroll Tools Tax Rates And Resources Paycheckcity

2021 Payroll In Excel Iowa Tax Withholding Youtube

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

A Complete Guide To Iowa Payroll Taxes

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Iowa Paycheck Calculator Smartasset

The Complete J1 Student Guide To Tax In The Us

Iowa Paycheck Calculator Smartasset

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax