oregon tax payment deadline

Complete Edit or Print Tax Forms Instantly. On Wednesday March 25 Governor Kate Brown announced that tax.

The jackpot for Saturday nights drawing is now the largest lottery prize ever at an estimated 16 billion pretax if you were to opt to take your windfall as an annuity spread.

. Oregon has joined the Internal Revenue Service IRS in postponing the tax filing and payment due dates for individuals from April 15 2021 to May 17 2021. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. The Oregon Department of Revenue reminds taxpayers and tax professionals about due dates for the next quarterly estimated tax.

Call at least 48 hours in. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Oregon Marijuana Tax Oregon Department of Revenue PO Box 14630 Salem OR 97309-5050.

The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. Get Access to the Largest Online Library of Legal Forms for Any State. Ad Access Tax Forms.

Cash payments must be made at our Salem headquarters located at. 2022 second quarter individual estimated tax payments. In addition to the payment options below we also accept payments in person at our office locations.

What are the specific. Estimated payment deadline coming up. Even though the income tax deadline is postponed until july there are thousands who still have to pay oregon taxes by april 15 and that has local accountants concerned.

The Oregon Department of Revenue reminds taxpayers and tax professionals about due dates for the next quarterly estimated tax payments. Ad The Leading Online Publisher of Oregon-specific Legal Documents. April 15 July 31 October 31 January 31.

2022 third quarter individual estimated tax payments. Oregon withholding tax payment due dates are determined by corresponding federal due dates as outlined in the following rules. The due dates for estimated payments are.

Last week the IRS delayed tax filing and tax payment deadlines to July 15 without interest or penalties. Estimated tax payments for tax year 2020 are not. The Department of Revenue is joining the IRS and automatically extending the income tax filing due date for individuals for the 2020 tax year from April 15 2021 to May 17.

The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July. Filing of any Oregon information return. Rule 1 If the federal tax due is less than 1000 at the end of.

Finally any interest or penalties with respect to Oregon tax filings and. Select a tax or fee type to view payment options. At the direction of Governor Kate Brown the Oregon Department of Revenue announced an extension for Oregon tax filing and payment deadlines for personal income.

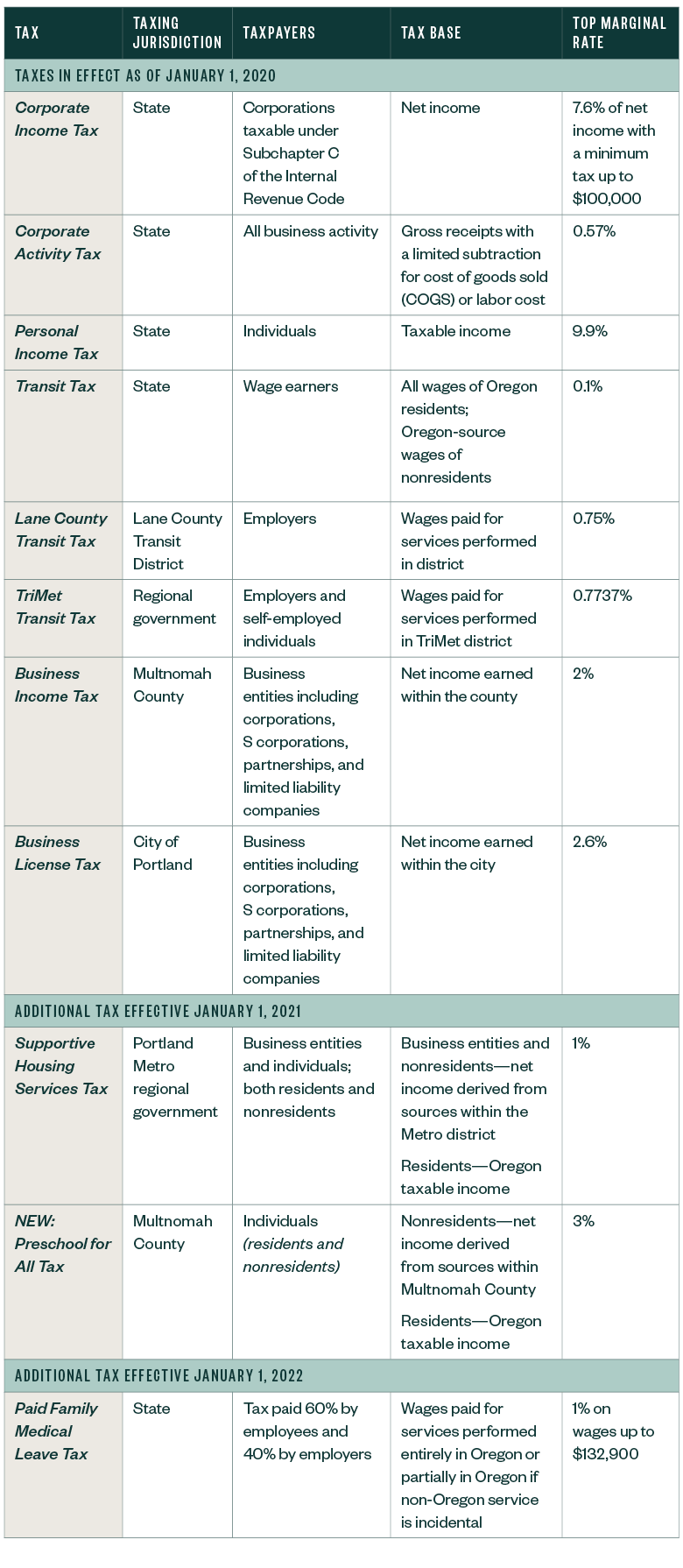

The Oregon Corporate Activity Tax. If you have any questions the tax office is open during regular business hours.

Estimated Income Tax Payments For Tax Year 2023 Pay Online

Oregon Reminds That Tax Filing Deadline Is April 18 News Kdrv Com

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Colonial Heights Va On Twitter Colonial Heights Personal Property Tax Payment Deadline Extended To July 30 Public Notice Personal Property Tax Payment Deadline Extended To July 30 Click Here For Full Notice

Department Of Revenue Provides More Details About Tax Deadlines News Tillamookheadlightherald Com

Oregon State Tax Updates Withum

Oregon S Estate Tax Filing Deadline Has Changed Here S How It Could Impact You

Oregon State Tax Updates Withum

Payments Oregon Office Of Economic Analysis

Kuow Washington And Oregon Have A Tax Off Who Wins

Income Tax Filing Deadline Moved To July 15 From April 15

Your Guide To State Tax Deadlines For Filing Returns Making Estimated Payments During Covid 19

Cottage Grove Sentinel Oregon Department Of Revenue Extends Tax Filing Deadline Payments

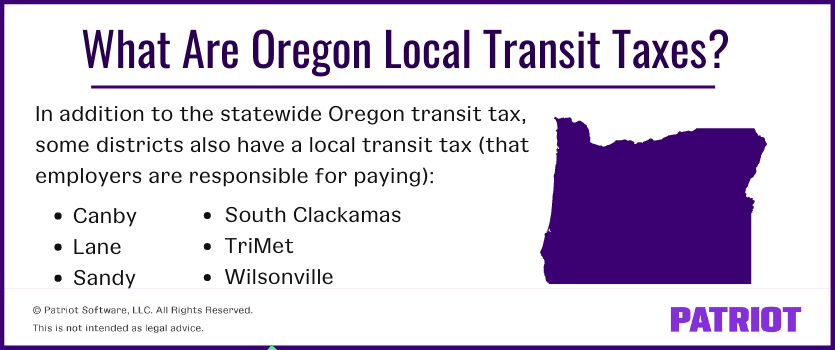

New Portland Tax Further Complicates Tax Landscape