capital gains tax proposal details

The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396. Kutay TanirGetty Images A budget draft proposal submitted to parliament by Portugals Finance Minister Fernando Medina calls for.

Proposed Tax On Billionaires Raises Question What S Income The New York Times

It would apply to those with more than 1 million in annual income.

. 2021 capital gains tax calculator. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. A 21 rate would apply to corporate income between 400000 and 5 million.

Because the combined amount of 20300 is less than 37700 the. The plan would invest nearly 79 billion. Capital gains taxes on.

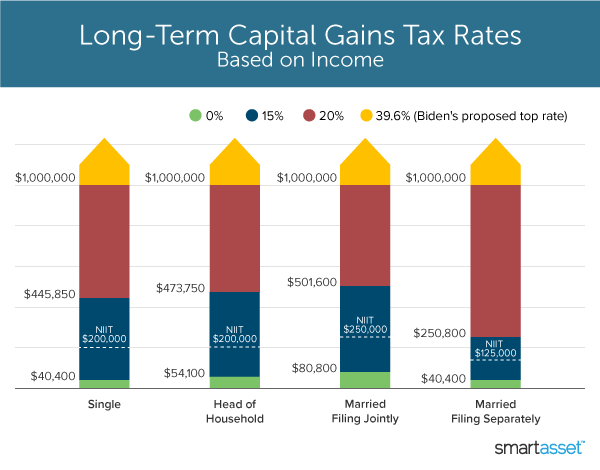

It would apply to single taxpayers with over 400000 of income and married. House Democrats proposed a top 25 federal tax rate on capital gains and dividends. Taxes long-term capital gains and qualified dividends at the ordinary income tax rate of 396.

Updated Oct 10 2022 at 1201 pm. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. Add this to your taxable income.

Some assets are tax-free. Weve been warning for years that the real plan behind the capital gains income tax proposals in the state legislature was to set up a lawsuit in hopes of. Currently all long-term capital.

The table below breaks down long-term capital gains tax rates and income brackets for tax year 2022. With average state taxes and a 38 federal surtax the. Under the proposal a.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. 9883143167 Payment Detail. Details of the proposals are below.

Bidens campaign proposal regarding capital gainsthe details. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. You also do not have to pay.

It also includes income thresholds for Bidens top rate proposal and the 38. Those earning income above 1 million would have their capital gainswhether short-term gains or long-term gainstaxed at 396 as well. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help.

Be sure to include your name and ASIS. 2022 capital gains tax rates. Long-term capital gains and qualified dividends are taxed at graduated rates under the individual income tax with 20 generally.

The plan would increase the top corporate tax rate to 265 from 21 impose a 3-percentage-point surtax on people making over 5 million and raise capital-gains taxesbut. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. Mar 26 2020.

Calculations for each capital gain or loss you report. Any other relevant details such as the costs of buying selling or making improvements to the asset and any tax reliefs youre entitled to. The first 400000 in income would be taxed at an 18 rate.

For example if you bought a painting for 5000 and sold it later for 25000 youve made a gain of 20000 25000 minus 5000.

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

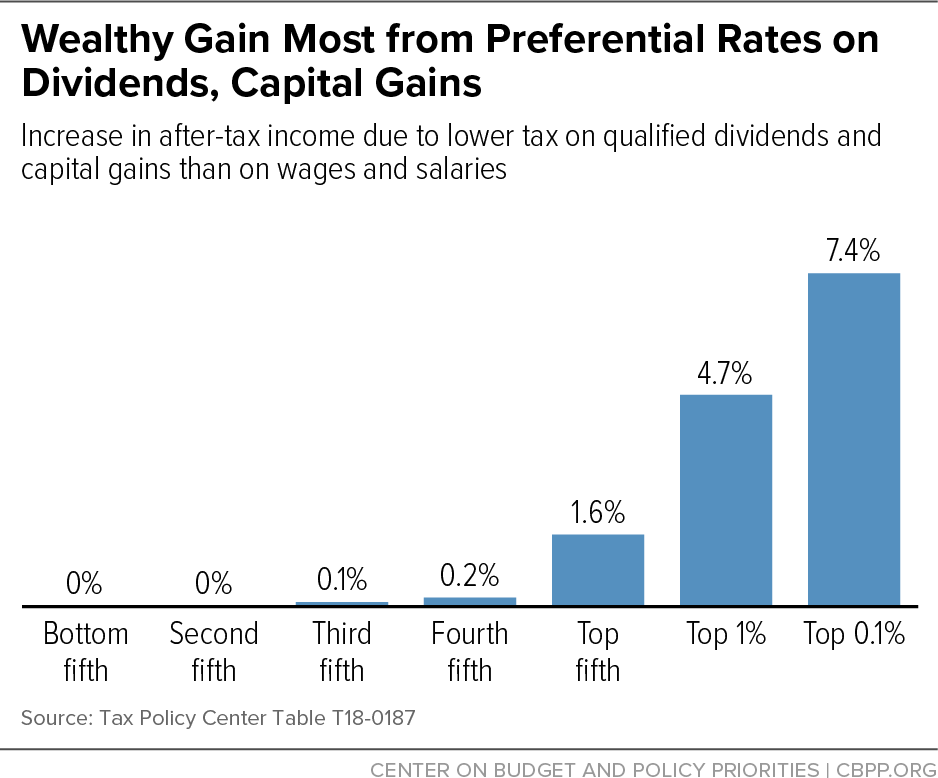

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Biden To Propose 20 Tax Aimed At Billionaires Unrealized Gains Bloomberg

Biden Focuses On Capital Gains Taxes As He Seeks Money For Social Programs Wsj

Guide To The California Capital Gains Tax Smartasset

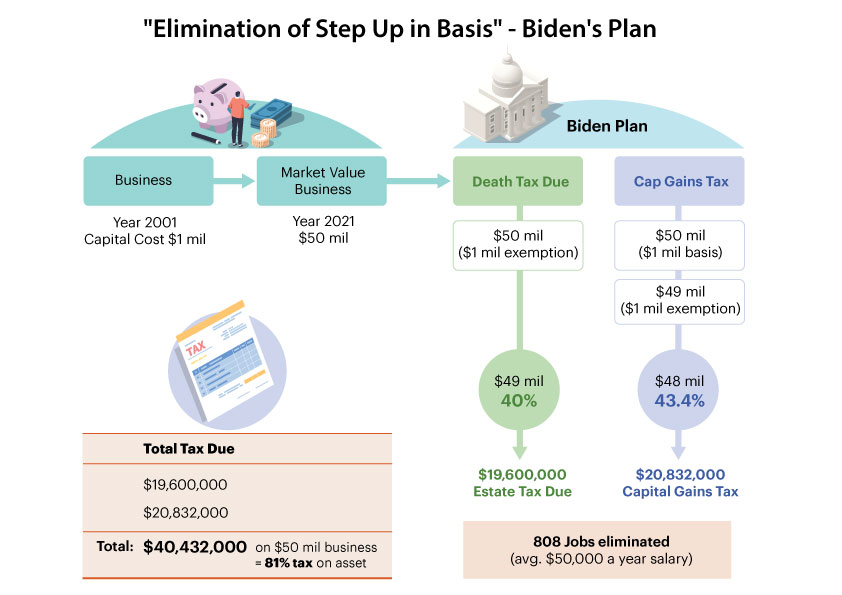

Warning Elimination Of Step Up In Basis Could Destroy Your Business Family Enterprise Usa

Capital Gains Tax In The United States Wikipedia

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

What S In Biden S Capital Gains Tax Plan Smartasset

Biden S Capital Gains Tax Plan Would Upend Estate Planning By The Wealthy Midwest Financial Advisors Group

Startup Employees Should Pay Attention To Biden S Capital Gains Tax Plans Techcrunch

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Capital Gains Tax In The United States Wikipedia

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

2021 2022 Long Term Capital Gains Tax Rates Bankrate

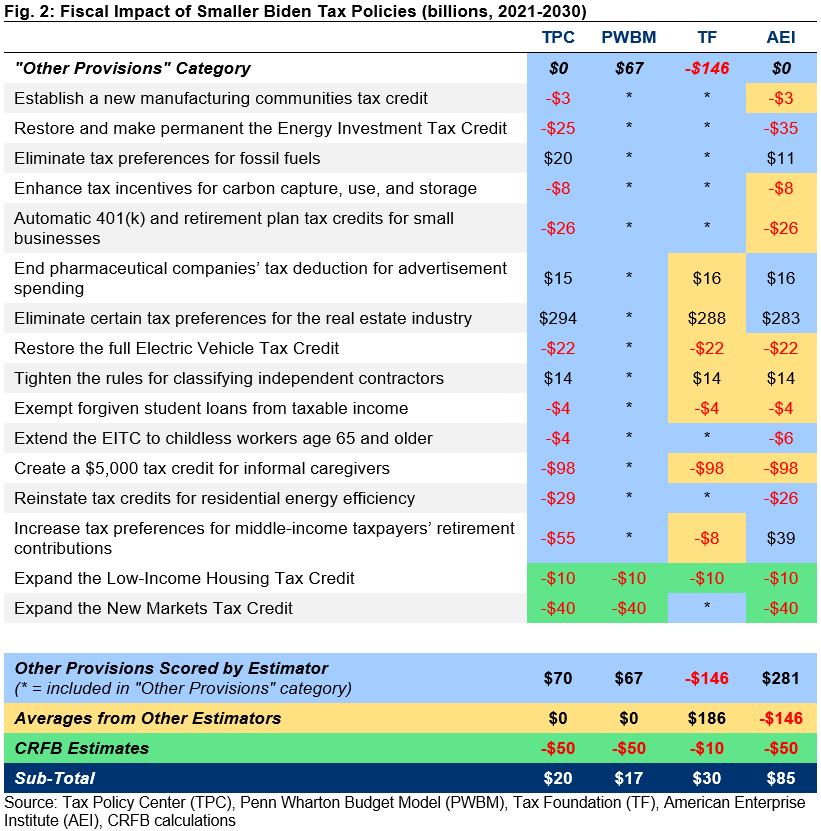

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

What S In Biden S Capital Gains Tax Plan Smartasset

Income Tax Increases In The President S American Families Plan Itep

Impact Of Green Book Capital Gains Proposals On Loss Harvesting Strategies Aperio